An investment life-cycle manifests from proven Vedic traditions

We can term the first 25 years of life as learning or preparatory phase

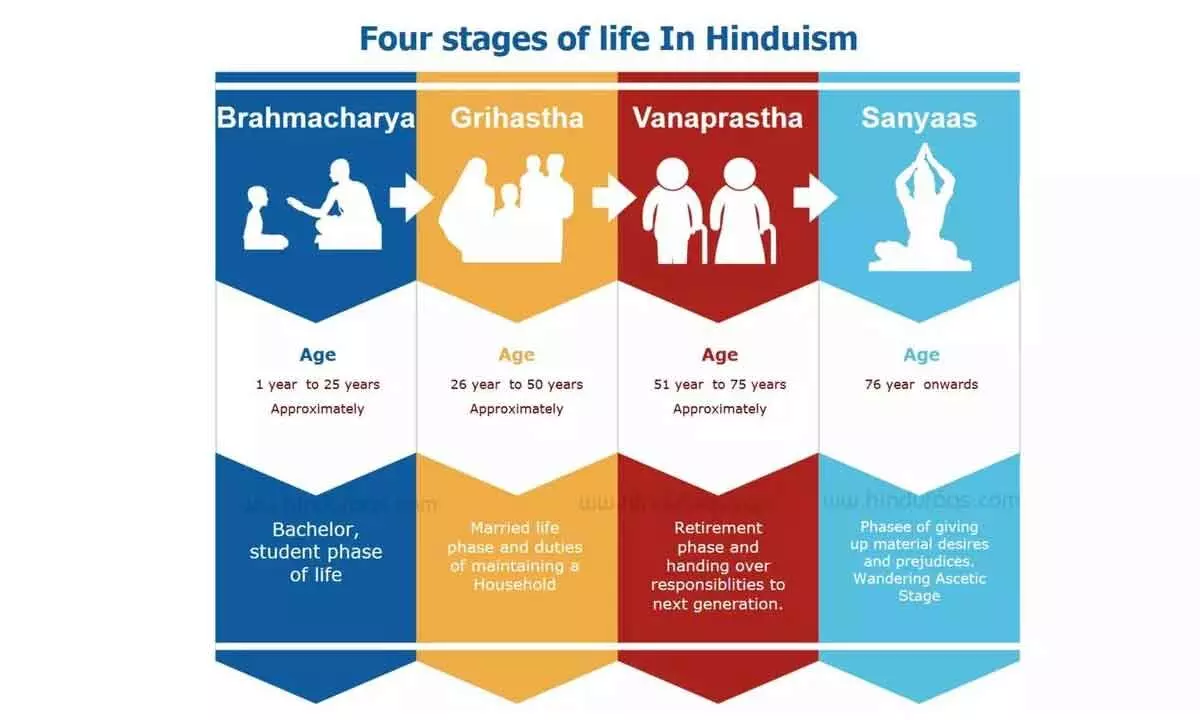

image for illustrative purpose

The learning from the first stage is to be practiced in real life in the second stage, where one’s consumption needs are very high, thereby leaving a little to invest or accumulate. This is the most critical stage in the investment lifecycle of an individual

Brahmacharya, Grihastha, Vanaprastha Aur Sannyasa: Ashram ye Jeevan Ke Chaar

Yojana, Arjan, Sanchayan Aur Bantan: Nivesh-Charan Ko Samajho Yaar-Shivam

Translation: Brahmacharya, Grihastha, Vanaprastha and Sanyas; are the phases, life unfolds.

Planning, earning, accumulation and distribution; are the stages, investment holds.

They say investment is a continuous process and a life-long journey. Naturally, as life traverses though different phases, so does the investment journey. We will try to understand how similar life and investment journeys are.

As per our Vedic literature, the entire lifespan of a human being has been divided into four stages of life called Ashram - Brahmacharya, Grihastha, Vanaprastha and Sannyasa.

Let us dwell in brief about these stages in life:

In earlier days, during Brahmacharya phase (5 to 25 years), the child would leave his family for acquiring knowledge/learning to an ashram, under the tutelage of a rishi or guru. This is the learning stage in life. Even today we can term the first 25 years of life as learning or preparatory phase. Though the forms of learning have changed drastically, it should not be limited to theoretical knowledge of subjects like science, mathematics, literature or philosophy. It involves acquisition of various life skills and life values like ethical values, discipline, self-realisation and abstinence, among others. A major learning during this stage is to remain focussed and not get entrapped into the pursuit of worldly pleasures.

The next stage is Grihastha, or Gruhasta-Ashram (25-50 years). This stage refers to the individual's married life, with the duties of maintaining a household, raising a family, educating children, and leading a family-centred dharmic social life. This ashram is also equated with incremental earning phase. This stage was considered as the most important of all stages in the sociological context, as human beings not only pursued a virtuous life but also produced food and wealth that sustained people in the other stages of life, as well as the offspring that continued the human race.

The third one is Vanaprastha (50-75 years) or the retirement stage, where a person consolidates his position and hands over household responsibilities gradually to the next generation by taking an advisory role, and gradually withdraws from the world.

Sannyasa, the fourth stage (75 years and beyond) is marked by renunciation of material desires and prejudices, represented by a state of disinterest and detachment from material life. The fourth stage can be identified with complete withdrawal from active work-life and pursuing some higher pursuit in life like self-actualization in terms of Maslow’s hierarchy of needs.

Quite coincidentally, the investment life-cycle of an individual borders on the vedic ashrams precedent.

The learning and planning (Brahmacharya) in investment refers to learning the basics of investment like starting early, identifying and quantifying goals, diversifying into various asset classes, tax planning, prudence, keeping away from greed and believing in the power of compounding, among others.

In the next stage, once basic learning is complete, the earning stage starts. Here, one needs to decide the proportion of consumption and savings or investment. The learning from the first stage is to be practiced in real life in the second stage, where one’s consumption needs are very high, thereby leaving a little to invest or accumulate. Disciplined investment as per risk appetite with prudence helps in building the resources that would be needed to meet present and future needs.

Planning and investing for creating the corpus for the requirements of the grihastha ashram like health of family members and education of children, house and other physical needs, marriage of children, other social and entertainment needs and post-retirement requirements is accomplished in this stage. Thus, this is the most critical stage in the investment lifecycle of an individual.

The third stage of the investment cycle is the accumulation and consolidation phase where the consumption needs are not so high and people are left with a big corpus to invest. In this stage of the investment journey, people are in the high-income bracket with children either settled or about to settle down in their own life.

Though earnings may be high, the capacity starts waning around this stage. They start shifting their wealth to less riskier assets. The discipline followed in the earlier two stages would support the lifestyle and the activities that one would like to pursue in the third stage. In the fourth stage, a gradual but complete withdrawal should be planned by passing on the remaining wealth to the off-springs and/or to the society for any cause that the individual may feel passionate about supporting.

This is a relatively new concept among wealthy individuals. Of late, professionals are advising on estate planning, making wills, donations, and establishing foundations, and the likes.

(The writer is Executive Vice-president, SBI Funds Management Ltd; Translation and content by Mihir Mishra, consultant with SBI Funds Management Limited)